In the Spring Budget, the chancellor increased the VAT registration threshold from a turnover of £85,000 to £90,000.

Lots of small businesses would have been jumping for joy. In fact, the Federation of Small Businesses (FSB), urged the Chancellor to increase the threshold to £100,000.

A small business would most probably like to stay below the threshold for the following reasons:

the inability to pass on the cost of VAT to their customers;

fear of additional admin burden; cashflow impact

However, one could argue that they are actually limiting their expansion, thereby not providing jobs for people or they may be closing for periods of time to limit income. There is a significant bunching of businesses with turnover just below the threshold.

Let’s take a look at the positives for a higher threshold:

Support for small businesses: One of the primary benefits of the VAT threshold is its support for small businesses. The threshold exempts businesses with turnover below £90,000 from registering for VAT, providing relief from admin burdens and compliance costs (such as employing a bookkeeper or investing in software). This encourages entrepreneurship and fosters growth within the small business sector.

Cash flow relief: For businesses hovering around the VAT threshold, not being required to register can provide significant cash flow relief. Without the need to charge VAT on their goods or services, these businesses can keep their prices competitive, attracting more customers and potentially expanding their market share.

Administrative simplification: VAT registration entails a range of administrative responsibilities, including record-keeping, filing VAT returns, and compliance with VAT regulations. By exempting smaller businesses from these obligations, the threshold simplifies administrative procedures, allowing entrepreneurs to focus more on their core operations rather than bureaucratic tasks.

Encouraging growth: The threshold creates an incentive for businesses to grow beyond the limit by providing a milestone to aim for. Crossing the threshold signifies expansion and success.

On the flip side, we have the negatives:

Distortionary effects: While the higher VAT threshold benefits small businesses, it can also distort competition within certain industries (think hairdressers, cafes). Businesses operating just below the threshold may have a competitive advantage over those above it, as they can offer lower prices by not charging VAT. This can create an uneven playing field and stifle market competition.

Threshold cliff effect: The cliff effect refers to the sudden jump in costs and administrative burdens once a business exceeds the VAT threshold. This can act as a disincentive for businesses to grow beyond the threshold, as the additional costs may outweigh the benefits of expansion. As a result, some businesses may artificially limit their turnover to remain below the threshold, hampering their potential to grow.

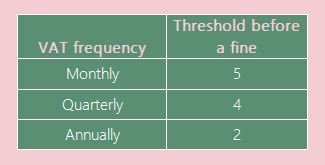

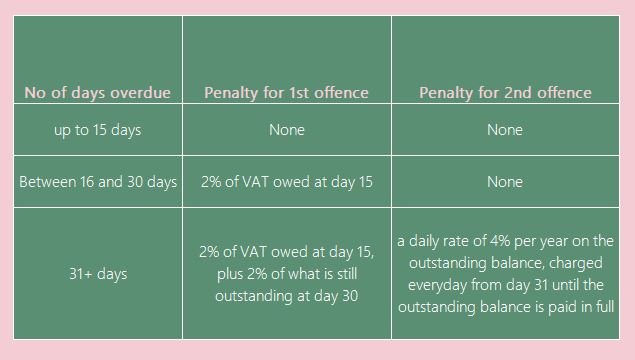

Staying compliant: Businesses must monitor their turnover closely to ensure compliance with the threshold (it’s on a 12 month rolling period), and ensure the often complex rules for VAT are followed.. This complexity can be daunting for start-ups and small businesses, leading to errors and unintentional non-compliance.

Revenue Loss for the Government: Exempting businesses below the VAT threshold from registration means foregoing potential tax revenue for the government.

Not so simple is it? That’s why I don’t ever want to be chancellor - someone will always benefit and someone will always suffer.