Things are a changing at HMRC in the world of VAT penalties.

The new regime is actually quite fair, in that it gives you a few chances before you get fined.

I am not a fan of missing HMRC deadlines, but sometimes these things are out of our control, and at least if it is entirely out of character for you, you won’t incur a fine in the first instance.

The new method is for VAT accounting periods starting on or after 1 January 2023, late submission penalties apply if you submit your VAT return late. This includes nil or repayment returns (harsh, but true).

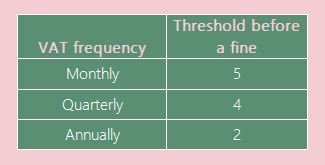

Each late return picks up a penalty point as per the table below. So you can actually miss 5 monthly returns before you pick up any points.

When you meet the threshold you then get a £200 penalty. Each subsequent late return has a £200 fine attached.

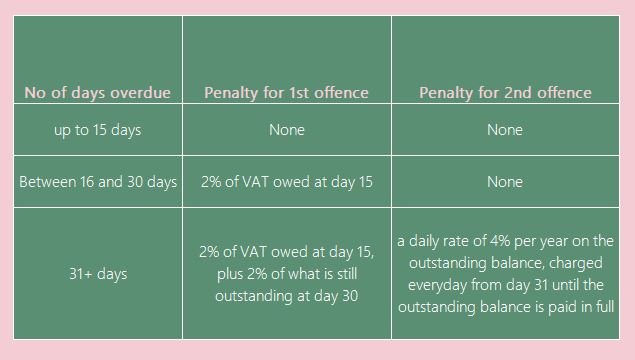

The interest on the VAT would also be due as follows:

It’s actually quite a fair process.

Penalty points expire after 24 months if you don’t reach the threshold, but if you are at the threshold then HMRC will ask for further compliance before wiping them off.

I think, if you are the point of missing that many VAT returns or payments, it would be time to get some advice from an accountant.

Don’t miss the deadlines folks, HMRC do offer help if you can’t pay, but missing the deadlines and ignoring them never was, and still isn’t, a good idea.